FY 2025

NYS Budget Analysis

FPWA Analyzes NYS' Commitment to Economic Security in the FY25 Budget

FPWA’s analysis, below, breaks down what made it in this year’s budget, what didn’t, and why this matters for the future prosperity of all New Yorkers. FPWA remains committed to ensuring that New Yorkers with low incomes have the necessary income and potential for building assets that enable them to thrive; to ensuring an equitable, just, and appropriately resourced human services sector that is responsive to the needs of New Yorkers; and to dismantling the unjust structures and systems that inhibit New Yorkers’ rights to dignity and power.

Key Findings

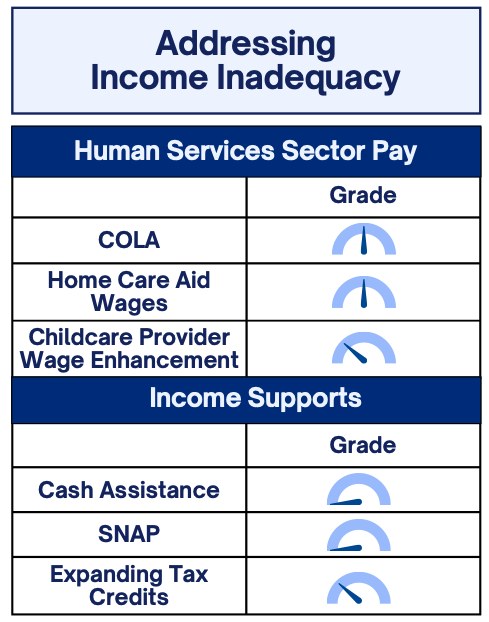

- While it provides a 2.85% cost-of-living adjustment to human service contracts, this does not go far enough for a workforce that is some of the lowest paid in the state.

- The child care workforce also risks being left behind, with a decrease in the funding contribution to the child care workforce compensation fund ($280 compared to $500 million in FY24).

- The state failed to include a long-overdue increase in cash assistance and SNAP, despite bipartisan support, and the well-documented benefits to individuals and the economy.

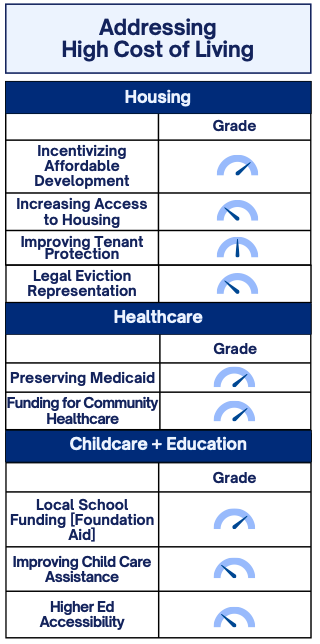

- It created and amended affordable development tax incentives, passing the 485-x tax credit for multifamily apartment building developments, and extending the 421-a tax credit.

- It passed good cause eviction protections, although provided carve outs for small landlords and did not create a right to counsel.

- It provided $1.3 billion in additional school aid and provided additional scholarship opportunities for New York State students.

- It provided $2.4 billion in funding to support services for newly arrived migrants.

- However, it missed an opportunity to raise $2.2 billion in additional revenue for vital services, rejecting modest income and corporate tax changes proposed by the Senate and Assembly.

Introduction

On April 20, 2024, New York State finalized its annual budget for Fiscal Year 2025 (FY25), totaling $237 billion. Central to this year’s negotiation was economic resilience, for both New York residents and state finances.

High costs and incomes that fail to meet the true cost of living have made New York a place that many in the working and middle-class feel doesn’t work for them. We’ve seen the evidence of this in the numerous reports of lower and middle-income residents leaving the state in search of a lower cost of living 1. This outmigration threatens to destabilize state revenues, preventing the government from engaging in changes needed to help lower the cost of living and retain its population.

The budget, which sets out the financial resources for the following year, while also establishing policy frameworks and programs for years to come, provides an opportunity for structural and strategic solutioning to current issues.

While the FY25 budget moves the needle forward on several key issues related to affordability, including extending the Empire State Child Credit, providing a limited Cost-of-Living increase for certain human service workers, and enacting a form of good cause eviction protections, true economic security for many New Yorkers remains out of reach.

The budget misses major opportunities to improve the lives of New Yorkers by leaving the human services sector under resourced and underfunded.

NYS Budget Addressing Income Inadequacy

One of the biggest barriers to economic security for New Yorkers is wages that fail to meet the true cost of living. As outlined in our recent report, nearly two out of five households in New York State cannot afford to cover their basic needs. That’s more than 2.3 million households.

Unfortunately, the state often exacerbates this issue, setting low wages for human services contract workers, with little room for small contract providers to negotiate fair updates to these contracts.

Limited COLA for Human Services Workforce

In the FY25 Budget, human service contracts receive a 2.84% Cost of Living Adjustment (COLA), falling short of the 3.2% required to keep up with inflation. Of the 2.84% adjustment,1.7% must be allocated directly toward eligible workers’ salaries, while the rest can be allocated to other service delivery costs. This increase, while important to workers, does not go far enough.

Human service providers are already asked to do more with less. If human services continue to not be properly resourced, these programs will experience inconsistent quality in service delivery, from lack of staffing, funding, and support. The FY25 Budget does not do enough to mitigate the critical problem that the human services workforce is an economic hairsbreadth from the clients they serve.

Home Care Workers Lose Out, Again

While home care workers avoid pay cuts in this year’s budget, with the Governor’s proposed cuts to the Consumer Directed Personal Assistance Program (CDPAP) not included in the final budget, the budget also does not include pay increases which are necessary to adequately compensate workers.

FPWA continues to advocate for fair pay for home care wages, ensuring that home health aides make at least 150% minimum wage. Less than 1 in 4 home health aides in New York can meet their basic needs with wages alone. As the fourth-highest employment occupation in the state, this statistic represents a crisis for New York State.

No Permanent Investment in the Child Care Workforce

FPWA advocated for $1.2 billion to create a permanent state child care fund to increase worker compensation and offer all child care workers, who work in licensed, regulated programs, compensation parity with similar positions in the public school system. Despite the urgency of the crisis facing the sector and the unjustly low wages of child care workers, the state fails to make any permanent investment in the FY25 Budget and instead reduces investment in the workforce, with only $280 million for the child care workforce compensation fund (compared to $500 million in FY24).

Like home health aides, the child care workforce is among the state’s most underpaid sectors. The average annual wage for child care workers in New York State is just $35,190, and our recent report shows that this group of workers struggles with some of the highest levels of income inadequacy. In New York State, 94% of child care workers are women, many of them women of color, so this is both an economic justice issue and a racial justice issue. 2

As discussed later in this analysis, we welcome the positive child care investments in the budget – including additional state funds to expand access to child care assistance; a subsidy rate increase for providers offering care during evening, early morning, and weekend hours; and an increase in funding for a small pilot project to provide child care assistance to families barred by federal rules from accessing assistance due to immigration status – but regret the lack of meaningful progress to address the systemic issues plaguing the child care workforce. We remain committed to ensuring the state’s child care sector is both equitable for workers and accessible for children and families.

A Call to Action on Human Services Wages

To address the totality of wage issues in the human service sector (including home health care and child care), a multipronged approach is required, rather than relying on one-time increases and negotiations. FPWA will continue to champion two structural solutions. Firstly, a wage board which would investigate the pay disparities between government employees and employees of contracted human services providers would be a meaningful step forward for sustainable contract payments and wages. Secondly, we call on the State to accurately measure the true-cost-of-living and utilize that measurement to base COLAs for the State’s human services contracts. Not only will the accurate measure of cost of living truly highlight what wages are needed to not just survive but achieve true economic security, this accurate measurement will provide more certainty to both workers and CBOs. We will continue to explore these options as part of our continuing work to ensure human services workers have the wages to thrive.

New York State Missed a Key Opportunity to Strengthen Income Supports

Unfortunately, the state fails to include a long-overdue increase in cash assistance in the final budget. The grant levels have not been increased in years, and the benefit levels are completely detached from economic reality, failing to help recipients meet even their most basic needs. In March, we and other advocates across the state were hopeful that there would finally be some movement on this issue when the Assembly included a partial increase in the grant in their budget proposal. This would have increased the portion of the grant designated for basic needs from $389 per month to $614 per month for a family of three. After years of inaction, this would have been a small but significant step forward, and a long-overdue recognition from the state that the needs of the lowest income New Yorkers matter.

Improving wages, especially in occupations where workers experience high rates of income inadequacy, remains critical to ensuring economic equity, but it is also critical to have robust income supports to help New Yorkers meet their needs and build economic security. This includes the cash assistance program, which provides direct cash aid to individuals and families with the lowest incomes. Many of these New Yorkers have disabilities or are struggling with physical or mental illnesses, others are caring for young children or family members. Often, New Yorkers enroll in cash assistance as a last resort after separating from a partner, experiencing domestic violence or homelessness, becoming sick, or losing a family member. SNAP (the Supplemental Nutrition Assistance Program) is another critical income support that provides food assistance to New Yorkers with low incomes. This program mainly serves families with kids, older adults and people with disabilities, and helps improve nutrition, reduce food insecurity, and strengthen local economies.

Similarly, a critical investment in SNAP is left out of the budget, which would have increased the minimum benefit to $100 across the state. Currently, the minimum benefit is just $23. This increase of the minimum SNAP benefit, while not enough to combat hunger across the state, would have been a step to reduce food insecurity and help New Yorkers manage the rising cost of food. The proposal was supported by a bipartisan group of legislators, yet it is not included in the final budget.

FPWA also advocated for expanded tax credits to support New Yorkers, but the budget only included a one-time supplemental payment of the Empire State Child Credit. FPWA instead advocated for a more expansive tax credit, the Working Families Tax Credit (WFTC), which would have created an improved and refundable tax credit by combining the Empire State Child Credit, the Earned Income Tax Credit (EITC), and the dependent exemption (DE) into one more generous credit. The WFTC would have offered a maximum credit of $1,600 per child, indexed to inflation. Critically, the WFTC would also have removed the minimum income requirements that exclude the lowest income families, and it would have expanded the EITC to include Individual Tax Identification Number (ITIN) filers. Unfortunately, this is left out of the state budget.

NY State Budget on Addressing Rising Costs of Living

During this year’s budget cycle, the high cost of living was central to negotiations 3, as Governor Hochul and legislators around the state pushed housing issues to the forefront of public discourse and pledged to act. Partial solutions for the rising cost of other essential services, including child care, education, and health care costs made it into the final budget.

Addressing the Housing Crisis

The budget includes several housing measures supported by FPWA. The legislature passes the 485-x tax credit for multifamily apartment building developments, extends the 421-a tax credit, which expired in June of 2022, to current multifamily apartment building developments that will be completed by 2026. New York also passes Good Cause legislation to address no-fault evictions, including carve-outs, which exclude some New Yorkers and allow localities outside of New York City to opt-in. The budget does not include the Housing Access Voucher Program which is also an FPWA housing priority.

While this budget takes some meaningful steps towards incentivizing house development, it fails to adequately address housing affordability, safeguard renter stability within housing with protections against eviction, or address homelessness, leaving some economic security issues of residents unaddressed.

FPWA supports the introduction of the 485-x tax credit, which provides a tax credit for developers of multifamily apartment buildings across the state. To access the tax credit, 20% of housing units in small apartment buildings, and 25% of housing units in large apartment buildings must be rent stabilized for renters making less than 100% of Area Median Income (AMI). We are grateful that the new tax credit includes more stringent affordability requirements that increases with the size of development.

We also support the extension of the 421-a tax credit, which expired in June of 2022, to current development that will be completed by 2026, and sunsetting the program, which will hopefully help speed completion of current development projects. Incentivizing increasing housing inventory, and including affordable housing options, can help alleviate the economic struggles of rent burdened New Yorkers. According to a recent study by the NYU Furman Center 4, approximately 46% of New York State residents are renters, of those renters 53% are rent burdened, or spend more than 30% of their income on rent and utilities and approximately 27% pay more than 50% of their income on rent and utilities each month. In this context, policies that drive the development of affordable housing are essential to the economic stability of New Yorkers.

While this year’s state budget offers some gains in housing affordability, its impact on housing stability is more mixed. Although incentives for new development can increase affordable housing options, renters still lack essential protections due to the passage of good cause legislation with significant carve-outs, and the failure to pass legislation passing establishing the right to counsel in eviction proceedings.

A new good cause eviction law in the budget provides many renters across the state protection from no-fault eviction and outsized rent increases. The version of the bill in the budget made several regressive carve-outs. The law does not apply to units owned by small landlords (owners of buildings with10 units or less or whose entire portfolio includes 10 units or less), renters in co-ops and condos, and renters in buildings built after 2009 (for their first 30 years of occupancy). The good cause legislation also follows an opt-in model outside of New York City, potentially leaving many renters unprotected from no-fault eviction. Moreover, the bill sets a higher than targeted inflation index for rent increases at 5% + CPI or 10% (depending on whichever is lower).

For renters who are now protected from no-fault eviction through the good cause legislation, their ability to assert their rights hinges on their access to legal counsel if facing eviction. Unfortunately, the state budget fails to establish a statewide right to counsel in evictions proceedings. FPWA is concerned about the ability of all New Yorkers to protect their housing rights. There is a power imbalance in evictions proceedings because tenants most often represent themselves, while landlords are almost always represented by attorneys. This undermines the fundamental fairness of eviction proceedings. A right that cannot be protected effectively does not exist.

Eviction from housing is a destabilizing event, that can drive adverse physical and mental health outcomes, education disruption, and job disruption. Consequently, strong eviction protection helps ensure the economic stability of individuals and families.

FPWA is also disappointed that the legislature fails to pass the Housing Access Voucher Program (HAVP), forgoing a tremendous opportunity to drive housing stability for New Yorkers across the state. This bill would have set up a statewide rental subsidy program for low-income families and individuals who are facing eviction, currently homeless, or facing loss of housing due to domestic violence or hazardous living conditions. Tenants would have contributed 30% of their income toward rent, with the rest covered by subsidies, with the payment standard set at 100% of FMR, and half of all funding would be directed towards homeless families. This is incredibly disappointing in a moment where New York’s shelter systems are struggling to transition individuals and families, both newly arrived New Yorkers and long-term residents, into permanent, stable housing.

Advancements in child care access will help families

The Enacted Budget includes $1.78 billion for the New York State Child Care Block Grant, an increase of $754.4 million, which will provide subsidies for 119,000 eligible children. The budget also includes a small – but important – child care subsidy rate increase for providers offering care during evening, early morning, and weekend hours (known as non-traditional hours), and those serving children experiencing homelessness. FPWA is pleased to see these measures in the budget as they ensure families who have been made vulnerable and families working non-traditional hours can access affordable child care. We know that it is families working in many of these jobs (e.g. janitors, nursing assistants, truck drivers) that face the highest levels of income inadequacy to meet basic needs. 5

Vital education funding will help secure New York’s schools and universities

The FY25 Budget includes $1.3 billion in additional school aid which can be used by municipalities to fund schools and pay teachers. These funds will be particularly vital for New York City, as it deals with the expiration of federal funding, as highlighted in our NYC Funds Tracker. The budget also includes the retention of the ‘hold harmless’ provision. This provision, which was proposed to be cut as part of the Governor’s executive budget, ensures that school districts get at least as much school aid as the previous year. Also, up for consideration as part of the executive budget was a change to the Foundation Aid formula – another change that could have led to school districts receiving reduced funding. While we recognize the importance of ensuring the school Foundation Aid formula is fit-for-purpose we are pleased to see that the adopted budget includes a more considered approach to reviewing how it is changed. Instead of rushing a change to the formula, the adopted budget includes $2 million to allow the SUNY Rockefeller Institute of Government to undertake a study into the formula, in consultation with state agencies and stakeholders. Taking these steps will help to ensure that no schools are unintentionally disadvantaged as the New York State Education Department considers changes to how it funds schools across the state 6.

We are also pleased to see that the FY25 Budget includes an expansion to New York’s Tuition Assistance Program in terms of both availability and funding. Part-time students in New York will now be eligible to participate in the program, which was previously limited to only full-time students, and the parental income threshold for applicants will be increased from $80,000 to $125,000. The minimum award amount has also been increased from $500 to $1,000.

Relatedly, school districts will be required to verify that all high school seniors complete either the Free Application for Federal Student Aid or an application for the José Peralta New York State Dream Act (which provides aid to undocumented and other non-citizen students). The change will require districts to notify students of scholarship opportunities and financial aid options twice a year, while providing optional referrals for support and assistance to apply.

We are pleased to see the expansion of both initiatives that help promote the economic security of students, something we know is a key driver of school completion rates. We have long championed the importance of financial supports for students, including through our own Educational Opportunity Scholarships, and our work strengthening education outcomes in faith and local community settings. Ensuring education is accessible to all, regardless of income, is vital to advancing economic mobility.

Finally, we welcome the $1.29 billion for SUNY and CUNY capital projects and the $409 million for SUNY and CUNY operations. We know that SUNY and CUNY are vital for all New Yorkers, particularly New Yorkers from backgrounds that are traditionally underrepresented in university settings. Looking at CUNY alone, 76% of students are students of color, and 60% are first generation college students. 7 The CUNY and SUNY system is an essential component of New York City and New York State’s economy—generating growth, economic mobility, and tax revenue. We will continue to advocate that it is adequately resourced, now and into the future.

Budget Maintains Necessary Investments in Medicaid, But Does Not Address Systemic Issues in Healthcare Cost

The state budget for FY25 provides additional funds for Medicaid, sustaining critical access for existing patients. Specifically, it allocates $550 million to Safety Net Hospitals that provide to underserved, Medicaid-reliant populations. Additionally, the budget increases Medicaid reimbursement rates to hospitals and nursing homes by 4%, which, while falling short of the 10% increase called for by the Senate and Assembly, can help bridge existing gaps between State reimbursement rates and actual care costs. These steps are vital as inadequate state reimbursement exacerbates operational deficits for care providers, jeopardizing their financial viability. While these investments ensure ongoing services, we also call on the government to do more to address the healthcare cost pressures facing New Yorkers. The budget neglects to extend coverage to hundreds of thousands of uninsured New Yorkers or tackle escalating costs to individuals, thereby leaving healthcare expenses prohibitively high for many 8. FPWA continues to call for the State to ensure that everyone, including undocumented immigrants, are eligible for health insurance and are supported to access care, including through the Community Health Advocate Program. The State should continue to explore ways to bring down the cost burden down for individuals, including enacting medical debt reform 9.

Making New York Work for All

Welcoming our Newest New Yorkers

FPWA commends the inclusion of $2.4 billion in funding to support services for newly arrived migrants. Unfortunately, the legislature failed to pass the Access to Representation Act, which would create a right to counsel in immigration deportation proceedings. Immigrants have always contributed economically and culturally to the vibrancy of New York State. Investment in immigration legal services can help both newly arrived, and long-time resident immigrants to navigate not only deportation proceedings, but naturalization, work authorization, and several other immigration processes that allows individuals and families to focus on thriving within their new communities.

Missed Opportunity on Tax Reform

During the budget session, both the Assembly and Senate called for modest tax changes to ensure corporations and the wealthiest New Yorkers pay their fair share. These changes would have raised an additional $2.2 billion a year that could be used for vital services. Unfortunately, neither of these proposals are included in the final budget.

Ensuring New York’s vital human services sector is appropriately resourced has always been a priority for FPWA and ensuring that everyone in the state pays their fair share is a key part of guaranteeing there is adequate funding available for this cause. New York is the most unequal state in the nation 10. Over 2.3 million New Yorkers are struggling to afford basic needs 11 and at the same time it has a higher concentration of extreme wealth than anywhere else. New York has over 28,000 tax filers possessing wealth of more than $30 million, over 15,000 tax filers holding wealth of more than $100 million, and 130 billionaires together amassing over $660 billion in resources. The ultra-rich in New York State collectively hold $6.7 trillion in wealth.

A fairer taxation system is a key component to addressing inequality in the state, and ensuring the government has the resources it needs to fund services for New Yorkers who have been made vulnerable. As shown in our NYC Funds Tracker, our taxation system is directly related to the level of resources available to our governments. FPWA will continue to monitor how our governments raise revenue and allocate their budgets to ensure funding decisions reflect the needs of all New Yorkers.

Looking forward

FPWA remains focused on continuing our work to advance racial and economic equity in our state. FPWA remains committed to ensuring that New Yorkers with low incomes have the necessary income and potential for building assets that enable them to thrive; to ensuring an equitable, just, and appropriately resourced human services sector that is responsive to the needs of New Yorkers; and to dismantling the unjust structures and systems that inhibit New Yorkers’ rights to dignity and power. We look forward to continuing to work with the Governor, Senate, and Assembly, as well as our nonprofit partners and member organizations, to make progress on these important issues.

1 https://fiscalpolicy.org/latest-census-data-combined-with-fpi-analysis-reveal-new-york-losing-working-and-middle-class#:~:text=FPI%20analysis%20recently%20revealed%20working,the%20cost%20of%20living%20riseshttps://www.crainsnewyork.com/economy/census-data-shows-new-york-state-population-loss

www.osc.ny.gov/files/reports/osdc/pdf/report-15-2024.pdf

https://www.nytimes.com/2023/01/31/nyregion/black-residents-nyc.html

Stay in Touch

Join our network and learn about FPWA events and news.

All rights reserved.

LEARN MORE

ABOUT FPWA

GET INVOLVED