FY 2026

NYS Budget Analysis

On May 9, 2025, New York State finalized its annual budget for Fiscal Year 2026 (FY26), totaling $254 billion. Central to this year’s negotiation was economic security for New Yorkers, with the threat of a federal-government-induced economic downturn lingering over the state and nation.

The FY26 Budget moves the needle forward on financial stability by putting money back in the pockets of many New Yorkers, but the reality is that true economic security remains out of reach for many.

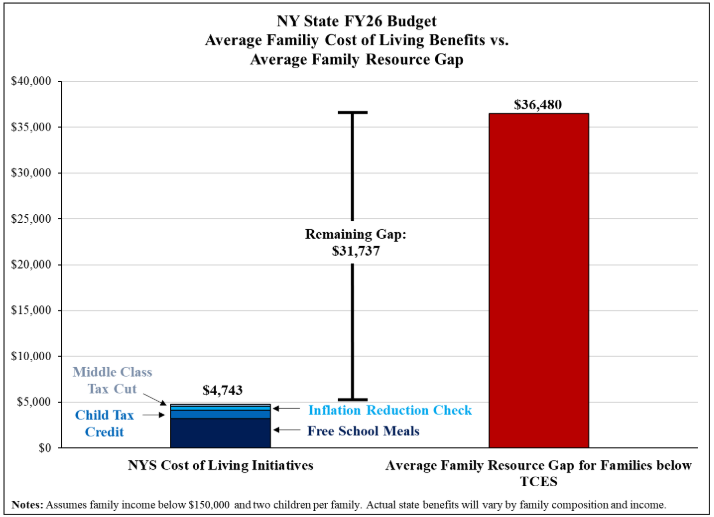

According to Urban Institute’s True Cost of Economic Security Measure (TCES), half of all New Yorkers—54%— are economically insecure, struggling to both afford basic needs like housing, health care, and childcare, and save for their futures. For households with children, that number rises to 63%. The median economically insecure household faces a resource gap of over $36,000 between what they need and what they have each year.

While the budget’s affordability measures will provide some welcomed relief, our analysis tells us these steps alone will not fundamentally change the economic reality for the majority of struggling families. Many of the initiatives are spread too thin to provide deep, lasting support, and more robust, sustained investments in areas like wages, affordable housing, childcare, and income supports are still needed to truly move the needle on economic security.

Drawing on TCES data, our analysis shows that the initiatives the governor is lauding in this budget barely make a dent in the gap that 54% of New York State households are facing.

Source: FPWA analysis of New York State Budget and Urban Institute data

Addressing Income Inadequacy

Urban Institute’s groundbreaking True Cost of Economic Security (TCES) report found that low incomes, rather than high costs, drive the highest rates of economic insecurity.

In this light, we welcome policies that put more cash in the pockets of low and middle-income families. However, we know that many of these policies do not go far enough to address the resource gap that families face.

Wages

One of the biggest barriers to economic security for New Yorkers is wages that fail to meet the true cost of living, especially for our vital human services sector.

Real wages for human services workers have remained stagnant over the past two decades. Workers in human services-related industries earned about $40,000 in 2023 compared to the statewide average of $90,000—up about 3 percent versus 12 percent, respectively, since 2000. Importantly, real wages for Home Health Care Services, the largest human services industry, declined by as much as 6 percent since before the pandemic.

This is why, as part of this budget, we called for the passing of policies that would make meaningful improvements in the take-home pay for many New Yorkers, including these workers. These policies included:

- A.1200 (González-Rojas)/S.415-A (Jackson), which would end the subminimum wage for tipped workers.

- A.2590 (Hevesi)/S.1580 (Persaud), which would establish a 7.8% cost of living adjustment (COLA) for eligible human services programs.

- A.1991 (Paulin) which establishes the Fair Pay for Home Care act, increases minimum wage for home care aides, and requires an annual adjustment to the regional minimum hourly base reimbursement rate.

We were disappointed to see that none of these initiatives made it into the final budget. Instead, the budget includes a COLA of only 2.6% for eligible programs and services.

This means we will continue to see human services workers themselves relying on the very supports that they are contracted to provide.

Child care wages

We also know that the childcare workforce is particularly constrained when it comes to economic security. Access to quality, affordable child care is not only essential for the well-being of families in New York State, but it is also essential for the well-being of our economy and our communities as a whole. The average wage for child care workers in New York State is just $35,190, one of the lowest among all professions.

In this light, we called for the budget to include a permanent state fund to increase child care worker compensation and retain workers. The budget did not include this fund. We are disappointed in the missed opportunity to advance child care wages.

Only real wage growth for human services workers, and all workers, will enable us to close the resource gap that 54% of households face.

Cash Assistance and Tax Credits

In addition to living wages for all those who are participating in the labor market, another key component of ensuring economic security for all is to have an equitable social safety net and tax and transfer system. Income supports and tax credits, especially those that provide direct cash targeted to households with the most need, can support individuals and families who are not able to earn wages that meet their cost of living. They also help New Yorkers weather challenging circumstances in their lives, whether it be caring for an aging adult or a child with a disability, experiencing domestic violence, or navigating an illness, injury, disability, or some other challenge. Direct aid through tax credits and programs like cash assistance, if administered equitably and without strings attached, can also give individuals and families agency by allowing them to make decisions about what they and their families need, supporting both their short- and long-term economic security.

Cash assistance

Having an equitable and accessible social safety net is one important aspect of preventing New Yorkers from falling into economic precarity. In this light, we have long advocated for policies to expand and strengthen income supports. Thus, we are especially disappointed that the budget did not include a long-overdue 100% increase in the cash assistance grant, which would have provided New Yorkers with the lowest incomes an immediate, although insufficient, boost in support.

The budget did include a much narrower cash-based policy called the BABY Benefit, which will provide a one-time cash benefit for new mothers who are receiving or eligible for cash assistance. This program will issue lump-sum payments of $1,800 per child at birth for almost 4,700 families. This program is a step in the right direction towards policies that can truly advance economic stability and close the racial wealth gap.

Tax credits and refunds

When it comes to the role of tax credits and the ‘inflation refund’ checks included in this budget, we see mixed success in the impact these will have. While we support policies that put more cash in the pockets of New Yorkers with low incomes, these policies could be better targeted.

Below we cover what each of these policies entails and then provide our main takeaway.

The enacted budget passed a reduced version of the Governor’s Proposal for inflation refund checks to residents who have been established in New York for at least a year. The initial proposal suggested a $500 check for married residents with an annual gross income (AGI) less than $300,000 and a $300 check for single residents or residents filing separate returns with an AGI less than $150,000. Instead, the refund is graduated by income level and the overall payments are smaller. If filing as a single taxpayer, a resident will receive $150 if their AGI is between $75,000 and $150,000 and $200 if their AGI is less than $75,000. If filing jointly or as a surviving spouse, the taxpayer will receive $300 if their AGI is between $150,000 and $300,000 and $400 if their AGI is less than $150,000.

While we support putting funds in the pockets of economically insecure households, we would support more long-lasting policies that are targeted at those most economically insecure. Instead, this one-off support is spread thin across a large number of households, including families living above the TCES.

The budget includes an expansion of the Empire State Child Credit. The expansion eliminates the income phase-in that has, until now, excluded the lowest income families from receiving the full credit amount. This means that families with very low incomes will now be eligible to receive the full, expanded credit amounts. It also increases the credit amount to $1,000 per child per year for children under age 4 beginning this tax year, and it increases the credit amount to $500 per child per year for children 4-17 beginning next year.

While FPWA supported a more generous proposal recommended by the Governor’s Child Poverty Reduction Advisory Council, which would have provided $1,500 per child annually for all children ages 0–18, eliminated the income phase-in, and indexed it to inflation, the expansion in the final budget is still a meaningful step forward.

The Enacted Budget passed Governor Hochul’s proposal to reduce tax rates for the State’s first five tax brackets by 20 basis points (.2%) each over two years, reducing revenue by nearly $1 billion when fully phased in. This includes tax cuts for households earning up to $323,200. We would like to see these tax changes better targeted to those who are at or below the True Cost of Economic Security.

Our takeaway:

Policies are spread too thin and should be better targeted

Lower tax rates on low-income or low-wealth households can improve their effective take-home pay, helping them reach economic security in a straightforward way. This cash in their pockets means they don’t need to expend time or face indignity to obtain cash assistance. To this end we are broadly supportive of these policies to make an incremental difference for many families.

At the same time, we think the policies could be improved. We would have liked to see them better targeted. Instead of giving tax cuts and checks to households with resources well-above the TCES, the funds could have been better used to fund vital services, make a more meaningful impact on economically insecure households, or prepare for potential federal funding cuts as we explain below.

Addressing High Cost of Living

Initiatives to help households meet specific costs are vital. In New York the highest costs that families face are housing, childcare and healthcare.

Overall, the suite of policies in the budget made progress against these costs but for most families they do not go far enough.

Housing

Housing support is particularly important in light of President Trump’s recent budget proposal, which proposes a devastating cut to rental assistance — reducing funding by $27 billion below the amount provided in 2025 across five programs. [1]

One of the housing bills FPWA advocated for was A.1704 (Rosenthal)/S.72 (Kavanagh), which establishes the Housing Access Voucher Program (HAVP). We thus applaud the investment of $50 million for an HAVP 4-year pilot program. While far less than the $250 million ask to establish the full program, this is a step in the right direction.

The Enacted Budgets accepts the Assembly proposal to extend the State’s low–income housing tax credit for four years, through 2029, and to increase the yearly amount allocable by an additional $30 million, on top of the Executive proposal. The total tax credit available increased from $247 M to $305 M annually. The proposal would also allow buildings financed by certain refunded bonds to qualify for the credit.

Child care

We called on the State to ensure all New Yorkers can access child care, starting with guaranteeing child care assistance (CCAP) to eligible low-income New Yorkers. This included making child care a state-funded entitlement for families making less than 250% of the federal poverty level and increasing state funding for CCAP to account for growth in the program. We also advocated for changes to expand access to child care assistance for parents, eliminate barriers to accessing child care for children with disabilities, and end the practice of denying New York children child care assistance due to immigration status.

While the budget fell short in meeting these demands, it included a $400 million increase to CCAP. This will help New York City especially as the city faces a major funding cliff in the CCAP program, which has threatened subsidy availability for thousands of families.

Food

The cost of food continues to be a challenge for New Yorkers, so FPWA advocated for a number of investments in food access and anti-hunger programs. We are disappointed that the budget does not raise the SNAP minimum benefit to $100, nor does it create a state-funded food benefit program for New Yorkers not eligible for SNAP. However, we applaud the state for including funding and language to establish a universal free school meals program, which will provide free breakfast and lunch for New York children all across the state.

Our takeaway:

Policies make a step in the right direction but fall short of truly advancing economic security

While FPWA will always advocate for structural change to break down barriers inhibiting economic security, we also need policies to help those who are struggling here and now. In this light, these policies do not go far enough.

For example, the True Cost of Economic security tells us that the median food cost for households with children in New York City is $14,600. At the same time, the maximum SNAP benefit for a family of 4 is $11,700. In this light the current SNAP program only scratches the surface of what people need, leaving a gap of almost $3,000 per year.

We will continue to fight for policies to bring the cost of living down for all New Yorkers.

Making NY Work for All

Government has a role in providing the necessary infrastructure to ensure everyone can thrive. This includes functions such as human rights enforcement that uphold the dignity of all and protect economic security.

It also has a role to responsibly budget to ensure it is in a stable fiscal position to provide the vital services that so many rely on. This means making policy decisions about revenue that ensure the state is well resourced, and scenario planning and preparing for potential shocks that may impact its ability to provide these services.

Human Rights Enforcement

Discrimination, particularly in the workforce, is an economic security issue which prevents qualified New Yorkers from getting jobs or promotions, receiving a fair wage, and enjoying a safe work environment that both meets safety standards and is free of harassment. It also undermines career trajectories due to lack of promotions, loss of wages, job turnover, and the adverse physical and mental health outcomes associated with employment discrimination. It’s essential to ensure that government is adequately resourced in order to fund the services that combat these issues.

In this light, we were pleased to see the FY26 Budget provide $31.7 million in appropriations for the New York State Division of Human Rights, a $12 million increase from FY25 attributable to additional staffing and operational improvements. This represents an historic 56 percent increase in funding from FY25.

This is significant given threats to civil rights at the federal level and years of disinvestment at the city level in the New York City Commission on Human Rights, as highlighted in our City Budget Testimony and NYC Funds Tracker.

Preparing for uncertainty

The budget shows that the state could be doing more to prepare for federal cuts and undertaking contingency planning. This is evidenced with some of the revenue-side policies being a missed opportunity for the state to invest in people’s long term economic security.

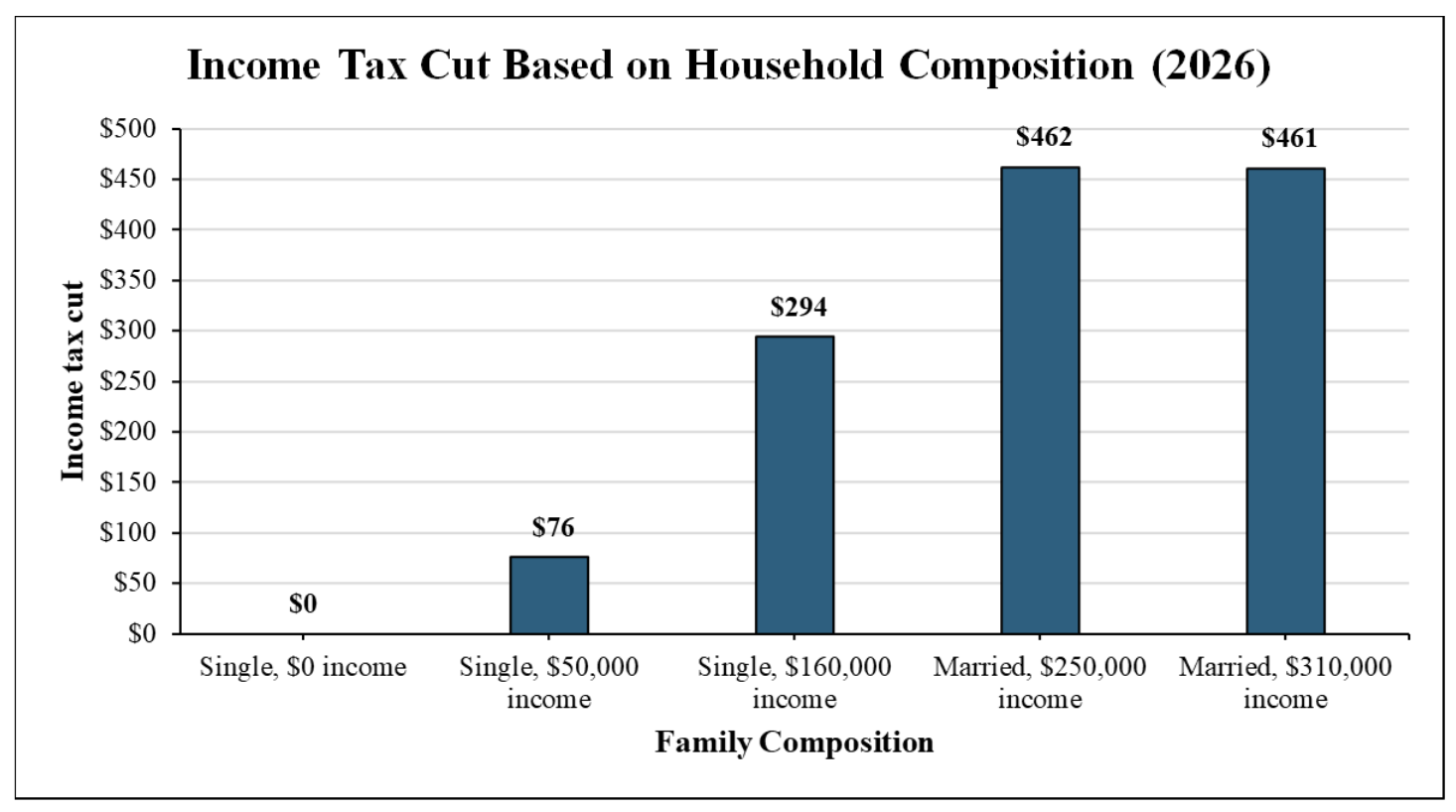

As mentioned, we welcome policies that put more money back in the pockets of families that are struggling to achieve economic security. However, the reductions in personal income tax rates also flow to those who are well above the TCES ($129,000 in New York State). The income tax rate changes will cost $1 billion per year with only 15 percent of the benefit going to households making under $100,000. On the other hand, it is households earning between $250,000 and $310,000 who benefit the most, as shown below.

The end result is a policy that will struggle to make a real difference to any of the impacted families. Families earning significantly above TCES have already achieved a level of economic stability. At the same time, families below TCES will receive some additional money in their pocket, but not enough to make a real dent on the resource gap they are facing. We argue that these tax expenditures should be better targeted at those who are at or below the TCES so that the amount for families reaching for economic security can make a real impact. We are also concerned that these changes which benefit higher earners are permanent, whereas the policy that provides cash to lower earners, the inflation reduction check, is temporary.

More concerningly, the state also missed an opportunity to both advance wealth equality and bolster revenue.

Raising revenue to provide vital services

While we don’t advocate for a tax system that picks winners and losers, our state’s laws and policies currently already do that: they help households with wealth get ever-wealthier. This state budget was a missed opportunity to reverse this trend.

The budget left off tax equity proposals, including the Senate proposal, S. 4437, to increase the two top rates (those making over $5 million and $25 million) by 0.5 percent. These proposals, championed by the ‘Share Our Wealth’ coalition, of which FPWA is a part of, would have generated over $1 billion in vital revenue for the State.

The enacted budget also missed an opportunity to permanently close loopholes that allow the generationally wealthy to avoid paying inheritance tax. The state only extended a rule, the Estate Tax Three-Year Gift Addback Rule, for another 6-years, rather than making it permanent. The three-year gift back rule prevents the granting of deathbed gifts to take advantage of the difference between the Federal and State exemption threshold level, while at the same time reducing one’s otherwise taxable New York estate. In addition, the enacted budget refrained from closing other estate-tax loopholes proposed by the Assembly, which would make add-backs deductible as debt for federal estate purposes.

Under current law, the corporate tax rate is set to be cut in 2027. The budget was a missed opportunity to reconsider this given the need to ensure revenue sources are strong in future years.

Missing the opportunity to ensure everyone, including corporations, pays their fair share inhibits the ability of the state to prepare for fiscal shocks, something that is particularly risky given the current federal administration.

Medicaid

In sharp focus this budget season was Medicaid, a public health insurance program that provides free or low-cost care to low-income individuals and families, including people with disabilities, children, older adults, and pregnant people. Individuals who receive Medicaid are experiencing poverty or are working in low-wage jobs that do not offer health insurance. Today, nearly 7 million New Yorkers rely on Medicaid, and it covers 42% of all births and 63% of nursing home residents. In New York City, Medicaid covers nearly half of the city’s population.

Through Medicaid expansion under the Affordable Care Act, New York has made great progress in reducing the uninsured rate and expanding coverage to about 2.6 million more New Yorkers since 2014. But looming cuts at the federal level threaten to roll back that progress, as Republicans in Congress plan to cut $880 billion from Medicaid over the next decade to fund tax cuts for corporations and the rich. If they get their way, it will be the largest cut to the program in history and will trigger a health care crisis in New York, forcing the state to significantly shrink the Medicaid program. It would also put New York health programs at risk, including the Essential Plan, which the federal government funds, and the Child Health Plus and the Qualified Health Plan.

Throughout the budget negotiations, Hochul and other legislative leaders called out the looming cuts at the federal level but stated they would not address the potential cuts in the state budget.

It is imperative that the state does everything possible to strengthen its Medicaid program given the federal landscape. Still, the budget lacked a contingency plan to prioritize funding in the state budget to offset the cuts.

While not included in this budget, in order to prepare for the federal attack on Medicaid, New York State can still take steps to expand health care. This includes passing the Coverage4All bill (A.1710, Gonzalez-Rojas/S.3762, Rivera) to expand Essential Plan coverage to New Yorkers who are undocumented. The state can repeal the asset test for Medicaid eligibility for people with disabilities and older adults. The state can also pass the aforementioned Fair Pay for Home Care bill (A.1112, Paulin/S.3599, Rivera), which establishes minimum hourly base wages for home care aides, to address the home care workforce crisis.

Conclusion

Ensuring economic security is more important now than ever with a potential economic downturn and federal funding cuts looming over the state.

Despite a policy debate that is often wide-ranging, economic security comes down to two things for individual households: resources and costs. This budget only scratched the surface in improving these–-regarding direct resources, it managed to close just 13% of the gap that economically insecure households face.

We will continue to advocate for policies and structural change that can advance these dual goals of increasing resources and bringing down costs.

For more information stay tuned for analysis and update on the federal and city budget, including through our NYC Budget Watch series.

For any questions please do not hesitate to sign up for Fiscal Policy Office Hours or contact Brad Martin directly; bmartin@fpwa.org.

Stay in Touch

Join our network and learn about FPWA events and news.

All rights reserved.